I have a good friend who’s the same age as me.

We went to high school together and still keep in touch via Facebook Messenger (I know…I’m such a millennial).

We also started investing in our retirement accounts at the same time, and contribute the same amount of money per month.

In the fifteen years since, my 401K account is pushing $430K.

Hers?

$190K.

Don’t get me wrong, that’s still a heck of a lot of money. But so is an extra $240K!!

And the compound interest we’re both earning off our paycheck contributions? The longer we’re invested, the larger that gap is going to get.

But how could hers be so different than mine?

It’s because up until a year ago, she was making the No. 1 mistake people make when it comes to their retirement accounts.

The money got transferred from her paycheck but it never got INVESTED.

That’s right.

Just because money comes out of your paycheck or your bank account and goes into your retirement account, doesn’t mean it’s actually invested in a stock, ETF, bond etc.

If you don’t tell your employer or your brokerage what to do with that money, it simply goes into what’s called a settlement fund (i.e. where retirement funds go to die).

A settlement fund is basically a glorified money market or high-yield savings account (HYSA). You’re going to get paid a little interest on your money, but that’s it.

So while I was making an average of 12% on my money the last 15 years, my friend was averaging around 3-4%.

Ouch.

But around here we don’t talk about problems without talking about solutions — so let me show you how to 1) make sure you’re not in the same boat as my friend, and 2) fix it today!

How to Fix It

Step 1: Log into your retirement account

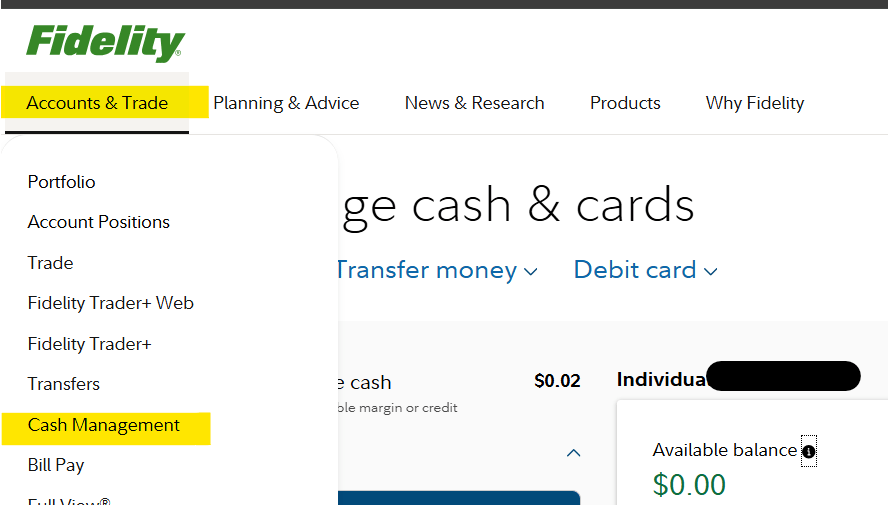

Step 2: Navigate to your brokerage’s cash management section. If you’re with Fidelity like me, you’re going to go to the Accounts & Trade tab, then scroll down to “Cash Management”. If you’re not with Fidelity you can either Google how to get to the right spot or ask your brokerage’s customer service.

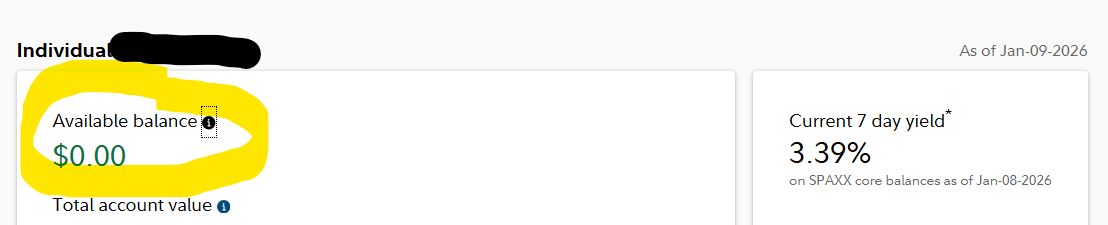

Step 3: See if you have money sitting in a settlement fund (sometimes also called a cash fund) — with Fidelity it’s ticker symbol SPAXX.

If you have a number other than $0 in the highlighted area above, move to Step 4 BECAUSE…you have money just sitting in your brokerage’s cash account.

And around here we don’t let our money slack off. It has to work for us, and it has to work hard!

You can also see the current rate you’re earning on that cash to the right — as of the date of this writing, 3.39%.

If you don’t have a balance, congratulations! The money in your account(s) is properly invested.

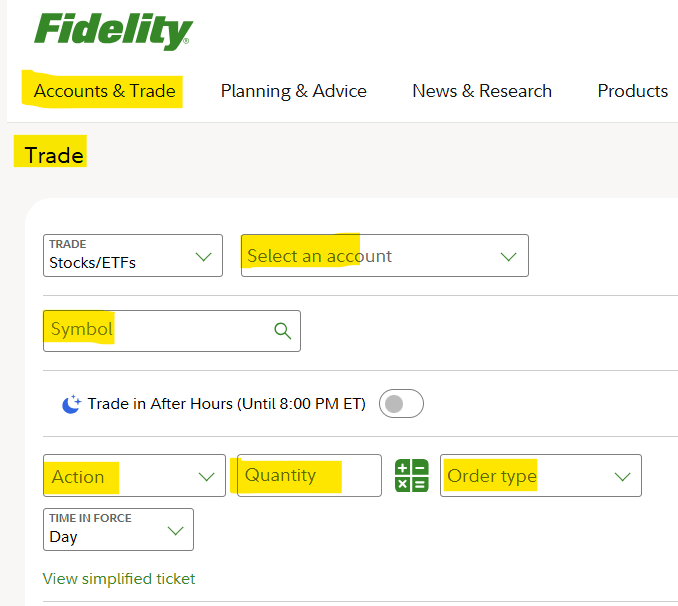

Step 4: Navigate to the area of your account where you can make trades (ie. buy assets), and pick an investment to buy. Below is an example of Fidelity’s trade menu — fill in the highlighted parts and click “Preview Order”.

Side note: you won’t be able to trade more than you have cash available. So just keep that in mind when you’re selecting the quantity. For example, if you have $100 in cash, and the ETF you want to buy is $50/share, your maximum quantity is going to be “2”.

Step 5: Preview your order, and if it looks good, hit “Purchase”

Congratulations!!🥳

Your money is now properly invested, and you have the potential to earn WAY more on it than before. Nicely done!

Set It And Forget It

To make sure you don’t continuously have cash sitting in your settlement fund, AND to not have to check your account religiously (because quite frankly, no one has time for that nonsense), you’ll also want to set up automatic investments.

If you’re not sure how to do that, hit reply to this email and I’ll send you some screenshots.

Doing this gives you peace of mind that future paycheck contributions or bank transfers will always go into the market by buying whatever investment you want (or that your employer offers).

So you can get back to living your life, knowing your money is hard at work.

Ahhh! Sweet success.

🧠Investment Term of the Week: Net Worth

Your net worth is the difference between what you owe (liabilities) and what you own (assets).

When it comes to your finances, a positive (+) net worth is considered healthy, while a negative (-) net worth is not.

To calculate your net worth, subtract all your debts from all your assets.

Assets - Liabilities = Net Worth

An asset is anything you own that has monetary value. Liabilities are anything that you owe money for or on. They include things like loans, credit card balances, car payments, and mortgages.

It’s a good idea to keep track of your net worth over time to make sure you’re focusing your efforts on saving and controlling your spending, while also investing your money into things that appreciate (grow in value) over time, not depreciate. Doing this will increase your net worth.

⭐Tip: recalculate your net worth every 6-12 months to track your progress.

That’s all for today!

Your friend,

Charlie | Your Wealth Hype Girl

📌P.S. I’m getting ready to open up enrollment for my next Quiet Wealth Small Group Investing program. I only run these a few times a year and spots are limited to keep things super personal. Join the waitlist so you’ll be first to know when doors open.

This article provides educational information about investment strategies, not personalized financial advice. Consult with qualified financial professionals before making investment decisions. Charlie Dice and OJD LLC are not responsible for any investment gains or losses as a result of following advice given here.