I don’t know about you, but I really enjoy all the “your year in review” content I get around this time.

Whether it’s my Spotify most-played list or my credit card expense breakdown (ok let’s me honest, that was isn’t near as fun), I love looking back and seeing everything that’s happened in the last 12 months.

So I figured it was time to do that with my investments.

The Good…

2025 was another record bull year for the U.S. stock market.

Since it’s low in April, the S&P 500 has rallied over 30%. And its risen an amazing 90-96% (depending on your source), since it’s last really bad year in 2022.

Personally, I think we’re going to keep seeing upward trends — especially within the S&P and the NASDAQ 100 at least a few more years.

My investments in the U.S. stock market did very well this year.

Starting in my smallest investment account by volume, my taxable brokerage account with Fidelity — my returns in U.S. equities are all well in the green for 2025:

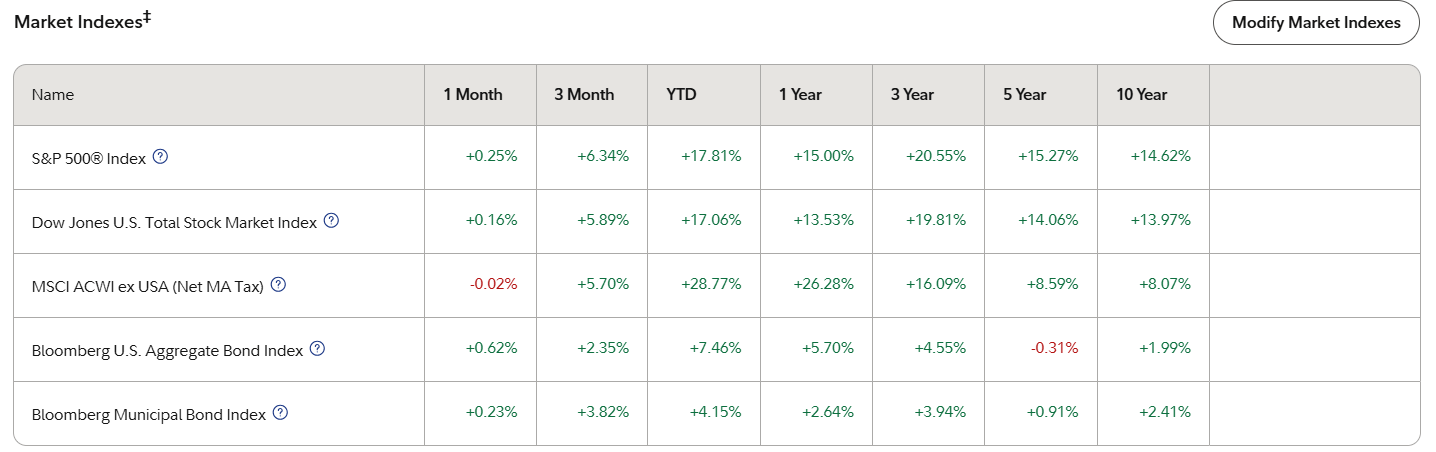

And if we look at the indices I invest in my account, they’re all solid, well-established sectors of the U.S. market that have trended up and to the right over the last 10+ years:

My biggest movers in this account were:

VTSAX (Vanguard Total Stock Market Fund) → +34.01%

GLTR (Abrdn Precious Metals Basket ETF) → 14.31%

AIQ (Global X FDS Artificial ETF) → 12.75%

There’s no doubt the stock market darling this year was tech and AI.

And while VTSAX has companies in these sectors, AIQ is by far my current asset most heavily invested in tech and AI (that’s basically the entire fund). So it’s no surprise it’s doing well.

In fact, this fund has 2/5 top performing stocks of 2025 in it.

And no, it’s not Nvidia or Tesla.

It’s Seagate Technology (a data storage company - ticker symbol STX), and Micron Technology (ticker symbol MU).

As of today, year-to-date (YTD) returns on these two were:

STX → 223%

MU → 181%

🤯🤯

This is why I love ETFs so much!

Unless you had time to do crazy amounts of research, you’d probably never know these companies existed, let alone invested in them (I wouldn’t!). But because I own AIQ, I’m able to share in these gains.

In my retirement accounts, I saw the same trends when it came to my stock investments, although one thing SHOCKED me!

Overall, between my traditional and Roth TSP (same thing as non-government employee IRAs), my portfolio is up over 16% for the year:

Given that I’m 38, I like to keep most of my allocations in riskier investments because I still have plenty of time before I’d need a fixed income.

Over 85% of my portfolio is invested in stocks. Here’s how they did:

C-Fund (tracks the S&P 500): +17.63%

S-fund (tracks the Dow Jones U.S. Completion Total Stock Market): +13.04%

I-fund (tracks the MSCI ACWI IMI ex USA ex China ex Hong Kong Index): +30.73%

That I-fund one SHOCKED me!

There’s an expression in economics:

“When the U.S. sneezes, the rest of the world catches a cold.”

It’s an idiom used by economists and political analysts to describe the significant influence the U.S. has on the global economy and international affairs.

The strength of the I-fund this year shows us that when the U.S. has an above-average year, the global economy does just as well, if not better in some areas.

This is why I personally think if you’re only invested in domestic markets, you’re losing out on a LOT of potential growth.

The Bad…

2025 wasn’t all sunshine and roses. Nothing in life every is right?

My accounts took a serious hit in April like every other investor when Trump announced his first round of tariffs.

And this month has actually been my worst month of 2025 — Merry Christmas! LOL

My taxable brokerage account is down 0.97% this month, and December is the only month this quarter that I’ve had an overall loss.

My worst performing stock of 2025 is CCCX — Churchill Capital Corp X USD CL A ORD SHS. It’s down over 23%:

But for me, this is just a speculative stock — ie. something I took a chance on. It makes up <1% of my portfolio and isn’t something that’s gonna make or break me.

I’m going to hold onto it for awhile longer and see how things play out. If it does bad again next year, I might consider selling it for a loss and use some of that to tax loss harvest (offset) any realized gains next year.

The worst performer in my retirement was the G-fund, up only 4.3%. But this shouldn’t be surprising to anyone.

The investment objective of the G Fund is to basically preserve your wealth, and generate modest returns above those of short-term U.S. Treasury securities (ie. bonds).

As long as it’s outperforming inflation (which it’s close this year), I’m ok. But again, given my age, I keep a very small amount of my portfolio invested in this as well as the F-fund.

The F-fund (fixed income) seeks to match the performance of the Bloomberg U.S. Aggregate Bond Index, a broad index representing the U.S. investment-grade bond market.

The new year…

So what is my investment strategy going into 2026?

First, I’m working on reallocating my taxable brokerage account to my preferred 45/40/15 split between dividend/value ETFs, foundational ETFs and growth ETFs.

Right now, I’m heavily skewed towards growth (which is great for returns!). But because I don’t want to sell and pay capital gains tax, the only way for me to “return to normal” is to invest more money into the areas that need a boost.

I’m also looking at possibly upping my growth ETF percentage to at least 20-25% in 2026. I’m waiting to see how the first quarter of the year goes and then might pull the trigger.

I plan on also selling more covered call ETFs next year — something I’m going to be diving into more in the newsletter as well. It’s a way to make more passive income while (hopefully) also keep your investment and making money of it in the form of profits.

Stay tuned!

If all these year-in-review wraps up teach us anything, it shows us how much we’ve accomplished, learned, and grown in such a short period of time.

And when it comes to investing, it shows us that no one has a crystal ball. If anyone tells you they can predict what markets will do in the future — run the other way as FAST as you can!

And maybe that’s the lesson: investing isn’t about knowing all the answers, but about staying in the game long enough to see how your unique story unfolds.

Wishing you and yours a very Merry Christmas and Happy New Year!

Your friend,

Charlie | Your Wealth Hype Girl

This article provides educational information about investment strategies, not personalized financial advice. Consult with qualified financial professionals before making investment decisions. Charlie Dice and OJD LLC are not responsible for any investment gains or losses as a result of following advice given here.