This week we’re jumping right in because it’s the holidays — everyone is busy and you need this info now.

Avoid these 10 investing mistakes at all costs.

Especially No. 1!

No. 10 — Too Many Accounts

The older I get, the more I want to simplify everything in my life. Including my investments.

Any of this sound familiar?

You have three different Roth IRA’s open with three different brokerages

You’ve changed jobs 5X in the last 10 years and still have 401K’s open with all five

You have 5 different savings accounts open because each time the bank offered an introductory APR you signed up

Sorry sis, but that is WAY too complicated for me.

Not only does this make your brain hurt, but you might also be getting charged fees from old accounts you may have forgot about. An extra $200-300/quarter in “admin fees” adds up quick!

Recommendation:

1 - 401K/traditional IRA

1 - Roth IRA

1 - individual brokerage account

Boom. Done.

No. 9 — Paying Too Much in “Advisor Fees”

I’ve looked at A LOT of investment portfolios.

And I’ve seen WAY too many that were paying thousands, sometimes tens or hundreds of thousands of dollars per year to financial managers or investment funds.

Even if you’re paying 1%…the math isn’t in your favor.

For example, if you have a 401K balance of $100,000. 1% of $100K is $1,000.

Let’s say your balance increases by $25K per year.

Every year you’re paying an additional $1,250 in fees than you did the year before.

That doesn’t even take into account compounding and what you’re losing there.

Over a period of 30 YEARS…this becomes an astronomical amount of money that should’ve been in your pocket and is instead in someone else’s.

Compare that 1% to something I’m personally invested in which is Vanguard’s Total U.S. Stock Market index fund (VTSAX) which has an expense ratio of just 0.04%.

I’m paying $4 in admin. fees for every $10,000 invested in the fund. If you’re paying 1%, you’re paying $100 for that same amount.

And the data shows us that most actively managed funds don’t do any better job “beating the market” than passively managed funds do. In fact, a lot of times they do worse.

Recommendation:

Log into your retirement or brokerage account

Look for the “Expense Ratio” of a fund you have money in

If the ratio is <0.1% that’s good

If the ratio is >0.1%, research and reach out to your brokerage to understand why

No. 8 — Paying Too Much In Taxes

No matter how much you dislike it, we all have to pay taxes at some point. It’s just part of life, regardless of where you live.

But I’m all about not paying more than we need to — legally.

When it comes to investing, one of the easiest ways to pay as little as possible in taxes is to maximize tax-advantaged accounts to the full extent.

These include 401Ks, Roth IRAs, 457s, and Health Savings Accounts (HSAs).

When you invest in a traditional 401K, your taxable income is reduced by the amount you contribute to the account.

You also save taxes on every dollar invested, and only pay tax when you withdraw the money later.

A Roth IRA works the exact opposite.

When you contribute to this type of account, you’ve already paid tax on that money so all your contributions, earnings and withdrawals are tax-free in retirement.

A HSA is what is known as a triple-tax-advantage account.

You’re eligible for one of these if you have insurance under a High Deductible Health Plan (HDHP).

In this account, not only do you not pay taxes on the money you invest, you also don’t pay any when you withdraw funds, as long as they’re going to pay eligible medical expenses.

That’s the triple tax advantage: tax-free contributions, tax-free growth, and tax-free withdrawals.

Recommendation:

Maximize your contributions to these types of accounts first. Every dollar invested allows you to pay less in income taxes.

No. 7 — Overly Complex Investment Portfolios

Too many people confuse diversification with overcomplication.

You can be diversified in your investments holding just one low-cost index fund.

Ex. VTSAX — one share and you’ve invested in every single company in the U.S. stock market.

Instant diversification. Simple portfolio.

Basic doesn’t always = worse.

Recommendation:

My 3-fund Foundation/Growth/Value ETF portfolio allows for even more diversification while still keeping your investments simplified.

No. 6 — Forgetting to Reinvest Dividends

If you’re invested in any dividend-paying stock or asset, every quarter (sometimes monthly), the company pays its shareholders a percentage of their profits based on the number of shares you own. These are known as dividends.

If you don’t tell your brokerage account what to do with these dividends, they just sit in a cash account (sometimes referred to as a settlement fund) within your portfolio and make little to no money for you. It’s like having your money in a regular checking or savings account at the bank.

No bueno.

Recommendation:

Log into your brokerage and/or retirement account

Make sure you’ve set things up to automatically reinvest your dividends to buy additional shares

The only exception to doing this would be if you’re currently living off those dividends as passive income. Then it’s ok to have them “cash out” each time they’re paid.

No. 5 — Paying Too Much Attention to News/Social Media Headlines

Every morning you log onto your computer or open up your smartphone and read The Wall Street Journal (WSJ), Bloomberg or watch Jim Cramer shout and ring fake alarm bells on CNBC.

I’m not saying keeping yourself updated on what’s going on in the world is a bad idea.

What is a bad idea is doom-scrolling, and taking every financial news headline you read as gospel. Worse yet, you make investment decisions based on them.

Remember, these news sources’ main objective is to get more eyeballs. More eyeballs equals more ad revenue or subscriptions.

How do they do this?

They write more interesting (sometimes click bait) headlines and articles. Anything to grab your attention.

A good rule of thumb I like to follow is:

Ask yourself if the headline or article you’re reading will have any impact on your investments 10+ years from now.

Nine times out of ten the answer is…NOTHING.

Recommendation:

Take in information, consider it, and move on with your day. Long-term investing is a marathon, not a sprint.

No. 4 — Chasing Higher Returns

If you’ve been a subscriber to this newsletter for any length of time, or you follow me on TikTok, you know when it comes to investing, I’m not a fan of anything that has to do with hype, speculation, or get-rich-quick schemes.

I’m talking penny stocks, meme stocks, new crypto coins or NFTs the finance bros are telling you can make you $100K next month.

If that were true, why would they be telling everyone else to do it?

If you’re constantly trying to beat the market to get an edge, you’re going to lose.

If everyone else is getting 10% returns, and you’re sure you can get 20-25% off some new underwater basket weaving startup some influencer is telling you to invest in…you’re in for a rough ride my friend.

Just like Vegas where the House always wins…in investing, the market itself always wins.

NO ONE has a crystal ball on what the markets are going to do in the long-run. An investment might be great today and completely crash tomorrow.

Recommendation:

Always remember that a stock represents a company run by humans like you and me

People aren’t robots. Over time they change and they make mistakes

Don’t try to beat or time the market. Embrace the returns you get and make small adjustments according to your personal risk tolerance and financial timeline

Focus on what you can control — expenses, taxes and the amount you invest

No. 3 — Being Too Conservative

Let’s say you’re pretty level-headed and you know not to chase high returns or invest in risky assets.

However, you suffer from the other side of the coin — you’re so afraid of losing money that you take little to no risks at all.

Ex. You have years’ worth of cash sitting in your regular checking or savings account making (close to) nothing, and when you do invest, you have half your money in ultra-conservative assets like government or Treasury bonds. And you’re in your 20’s, 30’s and even 40’s with decades more of earning and investing ahead.

If this is you, you’re being WAY too conservative.

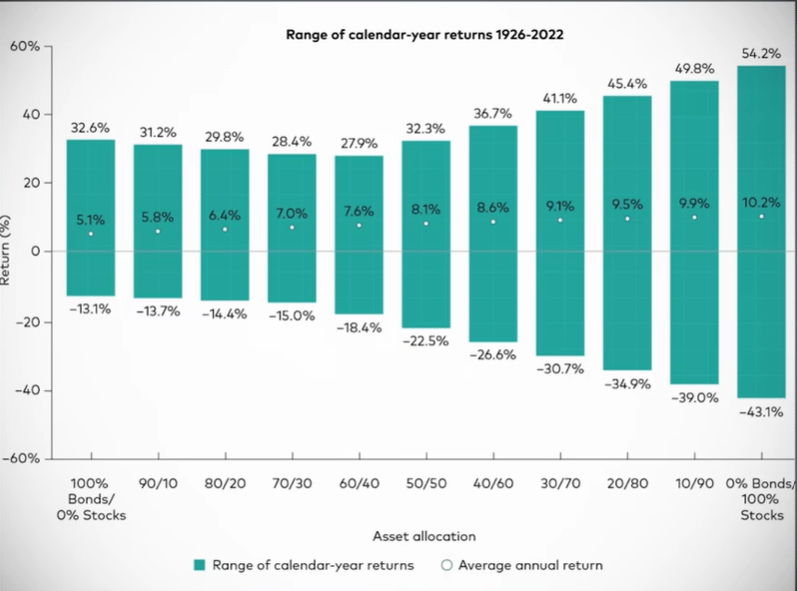

Let’s take a look at some data from Vanguard that shows the average annual return, as well as the worst single-year return on various stock-to-bond allocations in the U.S. stock market since 1926:

If you’re invested in 100% bonds/0% stocks (far left-hand side of the chart), in your worst year you only lost 13.1% of your portfolio. But your average annual return is only 5.1%.

Now compare that to the very aggressive portfolio of someone who invests in 0% bonds/100% stocks. Their worst year they would’ve lost 43.1% of their portfolio value, but their average annual return was 10.2%.

That’s 2X the returns you’d have if you’d invested in nothing but bonds.

Recommendation:

Don’t be overly conservative with your investments, especially if you’re younger and have a longer time horizon

Until you sell, you’re not locking in any losses

No risk = no reward

No. 2 — You Want Results NOW

True wealth is built over decades, not days.

If you aren’t patient enough to wait that long, don’t invest. Period.

You’ll end up losing more than you gain.

Long-term investing is all about time, consistency, and delayed gratification.

Now, I’m not saying wait until you’re too old to have fun with your money.

I’m saying that if you think you’re going to start investing today and retire solely off your portfolio in 5 years, you’re most likely going to be disappointed.

Warren Buffett, the greatest investor in modern history, made 98% of his wealth AFTER age 65.

Read that again.

Because of the power of time and compounding, Warren went from a net worth of $3 billion 34 years ago at the age of 65 , to over $160 billion today.

That means his wealth has compounded by nearly 5,233% in 34 years.

Wanting your investments to grow exponentially tomorrow is like expecting your kid to grow from an infant to a fully functioning adult in 3 years instead of 18. It just doesn’t work like that.

Unless we’re forced to, most of us are terrible at waiting. Especially in today’s world where everything is about instant gratification.

It’s not new. Believe it or not, this happened as far back as the 1630’s when the Holland Tulip Mania hit.

People were paying insane prices for tulips, only to have prices fall 99% within a year. Fortunes were made and lost in the blink of an eye.

Recommendation:

Strengthen your patience muscle

Remember, nothing worth having in life comes quick or easy

No. 1 — Forgetting to Invest In Your Own Life

Yes, we all need money to survive.

And having money offers you opportunities and the privilege of choice that not having it doesn’t.

But don’t spend so much time obsessing over having money that you forget to live your life.

The old adage is true — if you don’t have your health, you have nothing.

Add onto that, if you don’t have people in your life that care about you and for whom you care about back, what’s the point of having all the money in the world?

Money is just a tool. It can’t buy you true love or happiness.

That has to come from within and living your own life to its fullest.

How many lottery winners do we hear about who became ultra-wealthy, only to lose it all and say they wish they’d never won at all? That they were happier without the money.

Don’t sacrifice your health, relationships and overall well-being for the sake of a few extra dollars.

No one on their death bed ever said they wished they’d made more money instead of time spent with loved ones.

That’s all for today!

Reply and let me know which one of the 10 hit hardest for you and why. No judgment or shame here — at some point I’ve made all of these. Live and learn.

Your friend,

Charlie | Your Wealth Hype Girl

This article provides educational information about investment strategies, not personalized financial advice. Consult with qualified financial professionals before making investment decisions. Charlie Dice and OJD LLC are not responsible for any investment gains or losses as a result of following advice given here.

More than $10k in debt? We can help.

Debt happens. Getting out starts here.

Millions of Americans are tackling debt right now.

Whether it’s credit cards, loans, or medical bills, the right plan can help you take control again. Money.com's team researched trusted debt relief programs that actually work.

Answer a few quick questions to find your best path forward and see how much you could save. answer a few short questions, and get your free rate today.